Getting Integration Right

Best practices for law firm marketing teams undergoing M&A activities

Until the recent COVID-19 situation, the legal sector had been buzzing with merger and acquisition (“M&A”) activity. In 2019 alone, there were more than 100 strategic tie-ups; evidence that organic growth is challenging, especially at the pace demanded by clients, whose needs are constantly changing, as well as the attorneys who’re hungry to attract and retain more business.

In an environment where M&A can be “red hot,” getting it right—that is, identifying the opportunity and successfully executing upon it—is critical. The fate of a merger or acquisition depends entirely on the combining firms’ ability to integrate. In fact, we believe that integration broadly—encompassing business strategy, brand positioning, organizational management, communications, culture, and technology—is the fulcrum upon which the difference between success and failure hinges.

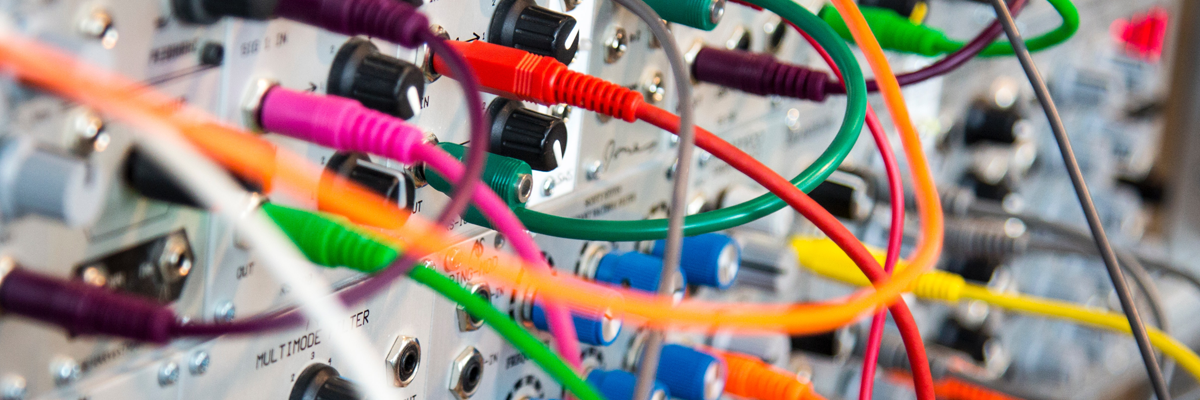

Integration is complicated and comprised of moving parts, details, and minutiae. It can also be overwhelming. If we factor in timelines and milestones, which are often compressed and rapidly approaching, all while the parties involved attempt to maintain existing obligations and current business through the transition, it’s tough to avoid oversights and pitfalls. This is especially true when it comes to technology, and specifically the systems responsible for marketing and business development content.

Many organizations can get this part wrong from the outset. In fact, 70% of the IT integration initiatives occurring during M&A activities that fail do so because of missteps in the earliest stages on account of weak integration teams and bad decision-making. Law firms can be even more susceptible, but not necessarily because of integration teams lacking strength or making poor choices.

As many legal marketing practitioners know, the service-oriented nature of being a legal marketer is germane to the sector. Often, small teams are supporting tens or even hundreds of attorneys, each of whom has his or her own brand and book of business to manage under the umbrella of the firm’s masterbrand strategy. Although a dated figure, a ratio of one marketer to 27 attorneys has been cited; meaning, for a firm with 500 attorneys, there are fewer than 20 marketers managing their bios and other requests, while also preparing client alerts, editing website content, preparing Chambers submissions, organizing events, and everything else marketing-related. That’s during a “business-as-usual” state.

During M&A activity, not only can this ratio of marketers to attorneys be thrown further out of balance, the uncertainty of everything—even with “strong” integration teams and “good” decision-making—raises the stakes, and can put marketing and business development teams in an uncomfortable position. Here are a few reasons why, offered through the lens of marketing technology:

—When two firms come together, they typically have their own, respective websites. Depending on a few factors, with politics being one, the outcome of M&A will result either in one firm’s website remaining and the other sunsetting or a new website being launched (for the new entity) and both (legacy) websites sunsetting. This will require migrating volumes of content from (at least) one Content Management System (CMS) to another.

Evaluating which system to keep and which to retire is only part of it. Determining when and how to move content, and which elements to keep and which to evolve or replace, is more difficult, and often falls to the marketers to manage.

—While legal services has its own particular lexicon, each firm also has its own voice and nomenclature. When two firms come together, one will have to adopt the voice and nomenclature of the other (or, they will have to establish a new one). This applies not only to brand, i.e., the tone of messaging, but to information architecture. For instance, where one firm may organize its expertise by Practices another might by Services. This will mean choosing one approach over the other (or choosing a new approach), and then reorganizing across all areas of expertise. It will also mean finding or making a home for areas of expertise where there is no overlap, which is likely given the rationale for M&A in the first place, i.e., securing new, differentiated offerings to drive competitive advantages.

For legal marketers, this can be tricky. Some firms, individually, may have tens of areas of primary expertise (e.g., Health Care and Life Sciences) with double or triple that amount in sub-areas (e.g., Health Care Litigation and Investigations, Health Care Reimbursement, Health Care Transactions, Health Information Privacy and Security, Health Policy and Legislation, etc.). During M&A, marketers will have to condense and synthesize them, and then choreograph which and how to map data from the legacy information architecture(s) to the new.

—The most-trafficked sections of a law firm website are the profiles of the attorneys. This information is the foundation for building the firm’s brand and reputation, and is therefore the most valuable. As with consolidating to a single CMS and aligning information architecture, when two firms come together their attorney bios must also integrate. This means moving bios from one CMS to another, assigning attorneys to the proper areas of expertise, and linking experience information to the appropriate experience database—not to mention how to handle search, new photography, alt bios, unique recognition, or considerations for outliers.

This task—that of managing attorney bios through M&A—is possibly the tallest. First, one firm’s marketing team must combine with the other. Next, they must assess and evaluate the technology, consolidate information architecture, orchestrate the migration of content and net-new content creation, and stage the transition from existing websites to some evolved state. Then, and throughout, they must communicate with the attorneys and manage their expectations while ushering in change—something which is difficult for all humans, and especially for attorneys whose firm bios are meaningful both professionally and personally. And, it’s not just the bio content that’s apt to change: attorneys may have to acclimate to new systems and processes, or make compromises, and marketers will often have to be the intermediaries between difficult decisions and headstrong attorneys.

With M&A activity unlikely to cease or slow down, how can integration be less painful or apt to fail?

As an organization that has helped several global and domestic firms complete complex mergers, we have some recommendations based on our experiences and best practices. First, we suggest that the combining firms’ establish an internal committee of marketing, business development, and IT stakeholders to serve as a centralized, accountable party to manage the digital transformation. Next, work with a third party to help identify priorities, requirements, and wish list items, so as to keep the decision-making process moving. With M&A deals taking an average of 38 days to close, there is little time to waste.

With our clients, we typically conduct a full day, in-person workshop during which we bring the combined team(s) together, identify all of the issues and potential considerations, conduct a proprietary process during which we discuss and map out next steps, and leave with greater focus, engagement, and clarity, as well as a rationale for the decisions made and a plan for communicating with internal stakeholders (including attorneys).

While we have found our approach to be highly successful, there are other ways, too. To avoid being a statistic for failure, avoid the misstep of copycatting: each firm, independent, merged, or acquired, is unique. Just because a competitor or aspirational firm did it one way, it doesn’t mean it makes sense for your team, your firm, your resources, or your goals.

###

If you’d like to read more on this topic, please check out our May 2018 article, M&A: Don't Overlook Technology.